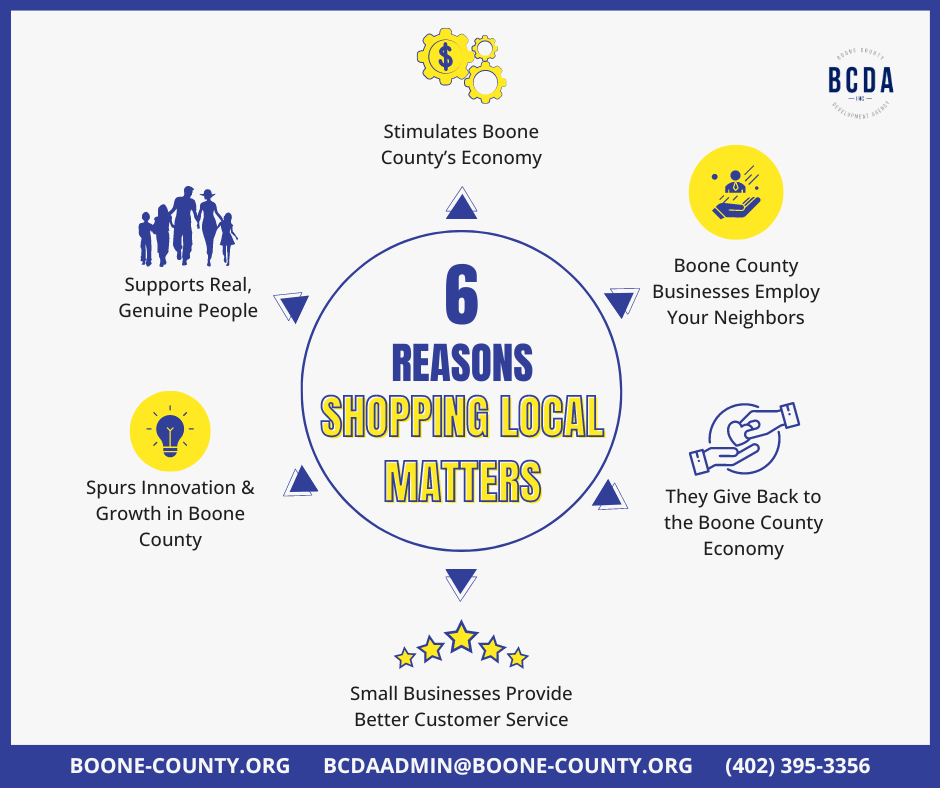

Running a small business is extremely rewarding, yet demanding at the same time. As a small business owner, you end up wearing many hats. You’re the marketing department, HR, customer service, bookkeeper, etc. It’s easy to see why so many small businesses fail when owners are being pulled in 100 different directions.

“Studies have shown a full 20% of small businesses fail in their first year, 30% in their second year, and 50% by year five. A full 70% of small businesses don’t make it past their tenth birthday.”

- Entrepreneur.com

In Boone County, we are dedicated to helping your business succeed. We have implemented numerous programs and funding resources to show our commitment to your dream. One of our top programs for small business start-ups is Energizing Entrepreneurs. This program is 100% free to new businesses in Boone County and you will receive a $5,000 grant upon completion!

The goal for Energizing Entrepreneurs and the rest of our programs is to set your business up for success from the beginning. However, if you’re reading this article as an established business owner, we are here to help you too. Let’s go over why small businesses fail and how you can turn it around if you see this happening to your business.

Small Businesses Fail By Not Having An Effective Business Plan

Operating a successful small business requires proper planning. A business plan is the framework you need in order to start your business, plus it lays the foundation for how your business will operate and grow year after year.

A solid business plan will let you know if your business will be successful before you even open the doors. Through market research, competitor analysis, cash flow and budgeting, and growth opportunities, you will be able to determine if your idea is feasible in the community you are in.

Helping you draft a business plan is the first step in our Energizing Entrepreneurs program. We will connect you with experts that have over 20 years of business planning experience to assist you in turning your vision into a solid business plan.

Small Businesses Fail By Not Maintaining Cash Flow

In business, you will continually hear the phrase, “Cash is King.” That’s because businesses cannot run without adequate cash flow year-round. Successful business owners know how much money is needed to operate effectively on a daily basis. And they know that excess revenue generated during the busy months needs to be reserved for their slow season.

The best way to manage common financial hurdles is to establish a realistic budget for your small business operations. Assessing your budget can help you stay in tune with how your products and services are priced, making sure that your prices are not too low. Keeping the prices of your products or services too low for too long will end up costing your business in the long run.

Not only does the Energizing Entrepreneur program help you establish a budget for your start-up, but BCDA also offers a Gap Financing program for new and established businesses needing help securing a bank loan.

Small Businesses Fail By Having Inadequate Management

Being a business owner does not automatically translate to being a good leader. If your small business requires you to hire employees then it’s important to know that your employees look to you for daily guidance and feed off of your mood. Employee performance, productivity, morale, and motivation can all be tied back to the effectiveness of their leadership.

Inadequate management even applies when you are operating as a one-person show. As a business owner, if you are feeling spread thin and find your customer service is declining, it’s time to outsource some of your tasks. A large number of small businesses fail because the owner becomes burnt out.

This is why it’s important to assess your strengths and weaknesses as a leader and address your weaknesses head-on. BCDA offers an Emerging Leaders Academy for anyone in Boone County looking to fine-tune their leadership skills and become a better leader.

Small Businesses Fail By Not Marketing Effectively

Operating a business is not like the Field of Dreams. Just because you build it, does not mean that your customers will come.

During the start-up phase of your business, you will determine your marketing budget and create a plan for how to market your business successfully. This includes social media, a website, print advertising, etc. The goal is to create brand awareness that keeps your business top of your customer’s minds year after year.

Reviewing your marketing strategy and budget is something that needs to be done every year. Successful business owners account for marketing needs on a monthly and yearly basis. They reserve funds for marketing efforts and keep track of their analytics and conversion rates to track their effectiveness.

If your business needs help establishing a marketing plan, contact the BCDA office to set up a meeting.

Small Businesses Fail by Not Innovating

Think about all of the businesses that you know and love. Then think back to what that business looked like when it first started. It doesn’t look the same, does it?

That’s because successful businesses are always finding ways to better meet their client’s needs and improve company operations. They are constantly bettering their products, services, facilities, customer service capabilities, etc. They are constantly innovating.

Small business owners looking to build a successful brand need to be looking for ways to add more value to their customers’ lives than their competition.

Small Businesses Fail by Not Being Consistent

Consistency in business comes in many forms. In order to build trust with customers, businesses need to be consistent in their messaging, customer service quality, marketing efforts, etc.

Consistency allows small businesses to build trust and deliver products and services efficiently and profitably.

But lack of consistency in these areas leads to your customers feeling confused and frustrated. This can translate to negative customer experiences and negative brand awareness.

Having a realistic plan in place for your business is the best way to remain consistent as it always gives you something to reference when you feel overwhelmed as an owner.

How to Avoid Small Business Failure

Whether you’re just starting out in business or have an established small business that needs a little help, don’t let this information discourage you. BCDA is here to help your Boone County business succeed.

If you’re looking to start a small business in Boone County, we highly encourage you to join our Energizing Entrepreneurs program. This program will help you create a plan for your business so you can prepare for the obstacles discussed above.

If you’re already an established small business but need a little help in one or more of these areas, contact our office. We can connect you with the right people to turn any situation around.